Buying CGM Supplies at the Pharmacy

People with diabetes could be seeing a turning point in ease of obtaining supplies for continuous glucose monitors, as more of these products make their way into local pharmacies.

While CGMs have traditionally only been available direct from the manufacturer or third-party supply distributors, they're now finally making their way onto the shelves of local pharmacies and even Costco stores around the country.

For example, the Dexcom G6 receivers, transmitters, and sensors are sold at discounted prices in Costco Pharmacies for the bulk chain's member customers. Opinions may vary on just how good those discounts are, but another big benefit for customers is that instead of waiting weeks for supplies to arrive in the mail, you may be able to walk out the door of your local pharmacy in a day or two with everything you need.

Along with Dexcom, the Abbott FreeStyle Libre system supplies are also available at pharmacies, and CGM maker Medtronic Diabetes is exploring pharmacy availability, too.

The takeaway is that lower-cost and more readily accessible purchase options are a must for any company wanting to succeed in the growing CGM market — that’s set to expand broadly to consumers, even beyond those with diabetes.

How much do CGMs cost at the pharmacy?

As always, insurance coverage varies by type, so the cost to each individual will depend on whether one even has pharmacy coverage for CGMs, and what copays or deductibles may apply. To keep it simple, here are the retail cash prices of the two systems currently available in pharmacies:

Dexcom

Users are thrilled to see the leading CGM on the market becoming more ubiquitously available.

At local pharmacies: Around the United States in CVS, Walgreens, and many other retailers, cash prices vary, but most locations we queried quoted the price for a G6 transmitter at just under $300, while a three-pack box of G6 sensors runs ~$400. Remember, too: Insurance may cover CGM supplies as a pharmacy benefit, meaning you could find these available at local or mail-order pharmacies for a flat copay, or with varying coinsurance and deductible amounts applied.

At Costco: To get the Costco pricing, you of course need to be a Costco member ($60) and also sign up for their free pharmacy program.

As of April 2021, the Costco Pharmacy membership cash prices are as follows based on the latest company info online:

- G6 transmitter: $277.62 each (or membership discount price: $132.24)

- Box of G6 sensors (three pack): $384.60 (or $303.74 membership discount price)

- G6 receiver: $417.92 each (or $203.29 membership discount price)

Note that you may see online search results showing varying price points, based on an older Costco Pharmacy deal. That earlier discount was dramatically lower: a G6 transmitter only cost $28.88, and a G6 touchscreen receiver cost $35.96! Since Costco discount prices are periodically adjusted, be sure to check in advance of driving to the store to purchase.

These Costco prices are self-pay only, as insurance isn't applicable there (also not Medicare or Medicaid). So for anyone who may have a lower insurance copay or deductible requirement, they may be better off sticking with their traditional purchase channels.

Caution: Unfortunately, lots of patients and even many Costco pharmacy folks are unaware of this savings program. So if asked, Costco employees may quote much higher prices, up to $1,100 for a single box of sensors — ugh! We're also hearing that some Costco pharmacists have been insisting that they must check insurance and that this G6 discount only applies if you've already been denied insurance coverage, which is NOT TRUE, as we have confirmed with Costco corporate contacts. Be sure to be insistent if you encounter this barrier.

Freestyle Libre

The Abbott Freestyle Libre Flash Glucose Monitoring (FGM) system is not (yet) what many consider to be a full-featured CGM with real-time glucose alerts for High and Low readings, but it does qualify as a continuous sensor and is growing in popularity.

This system has been available through national pharmacies like Costco, CVS, Kroger, Walgreens, and Rite Aid since it launched in late 2017. Senior public affairs manager Jennifer Heth at Abbott tells us that a majority of their 500,000 users in the United States are already getting their Libre 14-day-wear sensors through retail pharmacies.

Notably, Abbott says the Libre costs 70 percent less than the list price of other CGM systems currently available.

Here are the approximate prices for the Libre system in pharmacies:

- List price of $54 per sensor, according to Abbott (though retail pharmacies like Costco and Walgreens quote prices of $58–69)

- With commercial insurance, most patients pay between $10 and $75 per month for Libre 14-day sensors at participating pharmacies

- Handheld reader: $70 (though the separate receiver isn't required, as users can opt to use the FreeStyle LibreLink mobile app for iOS or Android for no charge)

Abbott tells us that building out their pharmacy purchase channel is an "area of focus" for the company that started in 2020.

"Pharmacists play a central role in patient care and are valued for their impact on improving outcomes for people living with diabetes," Heth says. "Abbott is dedicated to providing education on the rapidly evolving diabetes technology... Abbott has provided educational grant support for pharmacist continuing education programs with the American Pharmacists Association, Pharmacy Times, among others."

Heth also tells us that in addition to national and online programs, Abbott provides live peer-to-peer training sessions for pharmacists and webinars on the clinical application of FreeStyle Libre and CGM report interpretation using the Ambulatory Glucose Profile (AGP), a standardized one-page report that visually summarizes glucose trend data.

Medtronic and Eversense CGMs: Not in pharmacies

Sorry, friends. Medtronic confirms that it will be a while before their CGM supplies hit the pharmacy channel. Spokeswoman Pam Reese, director of global communications for Medtronic Diabetes, tells us: "We are currently exploring pharmacy options for our CGM. We have some pharmacy access already and are continuing to build our own internal pharmacy operations. In addition, we are exploring a retail pharmacy strategy."

It makes sense that the fourth CGM sensor on the market, the implantable Eversense from Senseonics, would not be available in pharmacies. This sensor must be implanted under the skin via a minimal surgical incision procedure by a qualified doctor. Still, we asked the company about any plans to sell supplies (replacement transmitters or charging cords) in pharmacies.

Senseonics' director of global PR and brand marketing Karen Hynes says no, explaining: "If Eversense is covered under someone’s pharmacy benefit, it would be mail ordered and shipped directly to the healthcare provider who is placing the sensor. Otherwise it would go through the DME (durable medical equipment) channel and would be shipped to the healthcare provider."

Why is CGM access in pharmacies taking so long?

The effort to make CGM supplies more readily available for retail purchase began back in 2015, when a half-dozen or more insurance plans began covering CGM supplies in a different way than they traditionally had.

They recategorized these devices as a "pharmacy benefit" rather than the traditional classification as "durable medical equipment" (DME). This meant people with certain plans would no longer be bound to buying supplies from designated third-party medical equipment suppliers or directly from the manufacturer, but rather could purchase them wherever medications are sold.

Anthem and UnitedHealthcare (UHC) were among the big insurance carriers taking that important first step toward eventual over-the-counter access to CGM supplies in local pharmacy chains like CVS or Walgreens. Other insurers have moved in this direction over time.

Even with some insurers now classifying CGM as a pharmacy benefit, it remains a "Your Insurance Coverage May Vary" situation in terms of how much any individual might pay for supplies — some plans require only a low, fixed copay applied to all pharmacy benefit items, while others require coinsurance, where you pay a percentage of the actual cost of the item. Still other plans require that you meet an annual deductible before any copay or coinsurance kicks in. It all varies.

Currently, most CGM users are still purchasing their supplies from designated third-party medical equipment vendors or directly from the manufacturer.

Per Dexcom’s talking points, pharmacy distribution allows for "a more seamless experience for physicians and patients, changing the once eight-step, month-long distribution process into four simple steps that enable a patient to get their Dexcom device in as few as 1–2 days through their pharmacist."

When Dexcom began planning for pharmacy availability several years ago (during the early G5 model days), it pushed for access by mail-order as well as in retail pharmacies — including "drop shipments" of orders prepared for pickup 24 hours in advance. Presumably, that "just in time" shipping policy was meant to avoid pharmacies stockpiling expired sensors that they can't sell, or running out of supplies.

Going into 2020, Dexcom is pushing for an increase in its CGM business going through pharmacy channels, by as much as 70 percent of their sensor business, to be exact. After 2019, the CGM manufacturer says it has now crossed the threshold of supplying more than 50 percent of its CGM supplies through pharmacies.

Walgreens makes CGM history

Walgreens made headlines in 2019 with its pharmacy expansion for the Dexcom G6, especially for Medicare beneficiaries who can now obtain their CGM supplies within that local pharmacy. Many Dexcom customers who use Walgreens have also started receiving automated emails and messages about syncing pharmacy and CGM accounts for more efficiency.

In fact, Walgreens' Find Care marketplace introduced a program in 2019 in which interested people with diabetes can proactively request a prescription for the Dexcom G6. They simply complete a questionnaire that is sent to their healthcare provider for review and potential prescription.

No doubt, as the next-generation Dexcom-Verily G7 product (designed to be more consumer friendly, fully disposable, and lower cost) moves forward and launches in 2021, we will see more big pharmacy chains adding CGM tech to their shelves.

Still, overall use of CGMs among people with type 1 diabetes remains low at about 35 percent. This is attributed in part to provider reluctance to prescribe the system.

Why doctors are reluctant to prescribe CGM

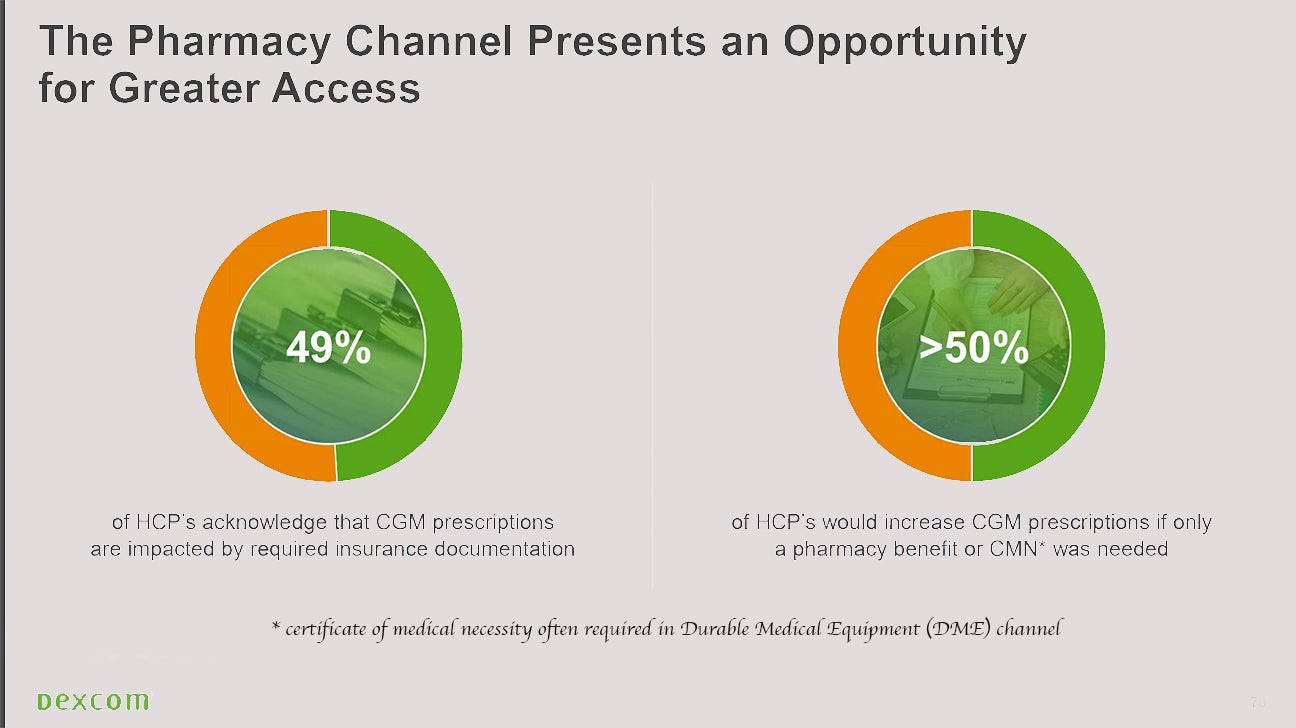

Dexcom execs tell us that 49 percent of doctors say all the insurance red tape currently impacts their willingness to prescribe CGM.

The company believes that more than 50 percent of healthcare professionals would increase the number of prescriptions they write for CGM if it were available across the board as a mainstream pharmacy benefit to all patients.

What they are essentially saying is that making CGM supplies cheaper and more readily available could be the key to helping CGM become a true standard of care.

As more people with type 2 diabetes are increasingly seeking access to CGM, it becomes even more critical to have lower-cost, easily usable options that can be purchased in mainstream places like local pharmacies. The rules may vary on how a prescription is written for a T2 patient on CGM, but that shouldn't interfere with buying in a pharmacy as long as the individual has a doctor’s blessing for using it.

Really, it's only a matter of time before all non-implantable CGM systems appear on pharmacy shelves, creating broader and (hopefully) more affordable access for everyone.

Comments